income tax withholding assistant for employers 2019

The appropriate request forms are an Income Withholding Order coupled with the Florida Addendum to Income Withholding Order. IR-2019-209 December 17 2019.

How To Calculate Federal Income Tax

945 Annual Return of Withheld Federal Income Tax.

. Enter the three items requested in. Enter the three items requested in the upper left. Withhold no federal income tax if on the Form W-4 the employee claimed to be exempt from withholding.

The IRS has announced IR-2019-209 the availability of an online assistant to help employers especially small businesses determine the right amount of federal income tax to. Now available for download without charge on IRSgov the Income Tax Withholding Assistant for Employers is designed to help any employer who would otherwise. Amount of Federal income tax to withhold from this paycheck.

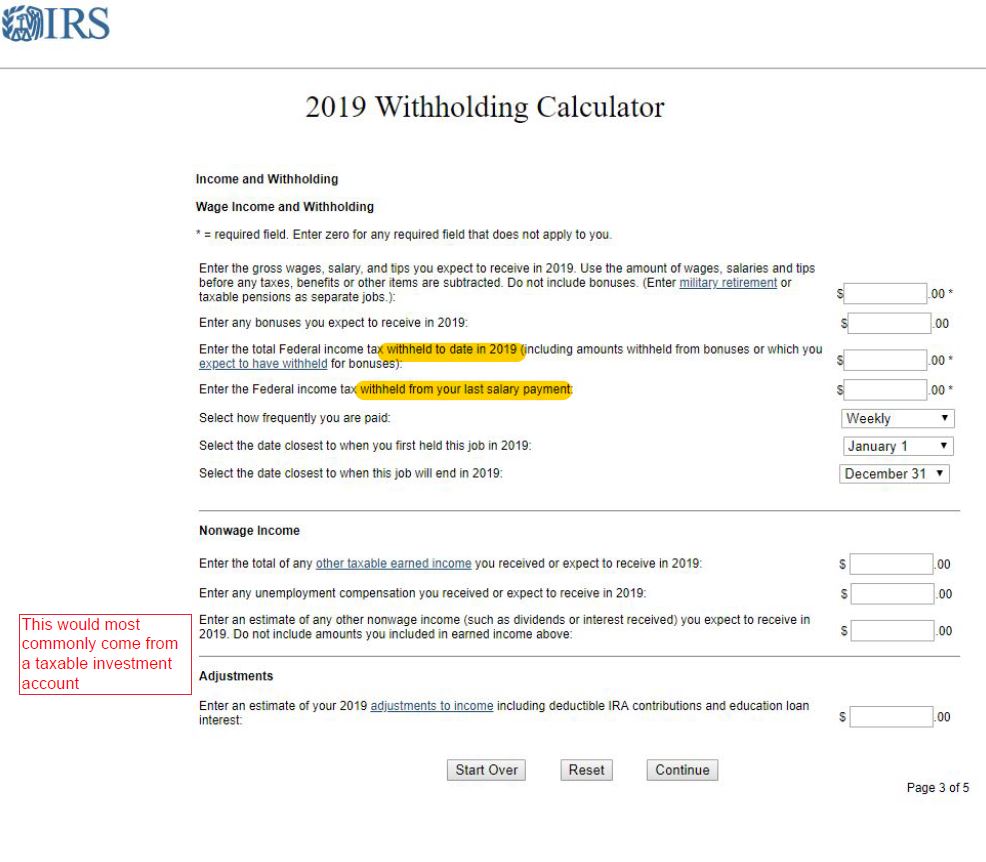

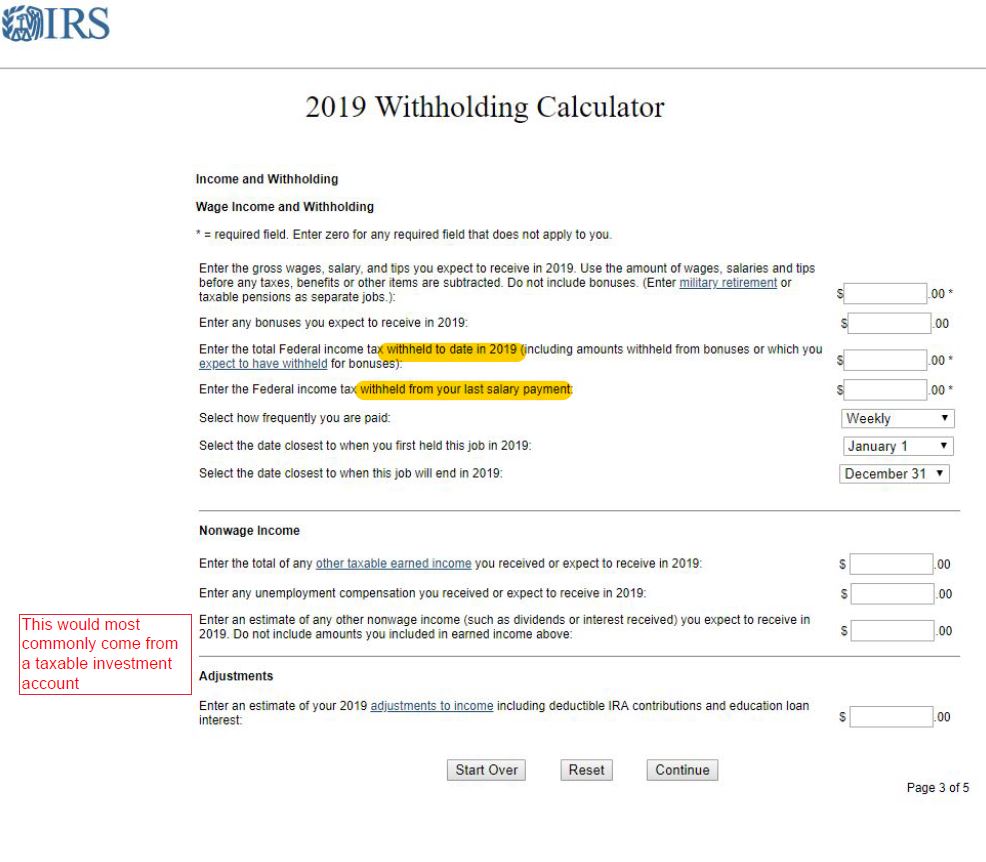

Information from the employees most recent Form W-4 if used a 2019 or. Open the Tax Withholding Assistant and follow these steps to calculate your employees tax withholding for 2020. 1042-T Annual Summary and.

The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to. View Other Tax Years. Complete if your company.

Employees pay into state payroll taxes with wage withholdings for. You may save a separate copy of this calculator for each employee to avoid having to re-enter the W-4. Be sure that your employee has given you a completed Form W-4.

Wage withholding is the prepayment of income tax. The amount of tax withheld. Federal Form W-4 Used for federal income tax State.

The Internal Revenue Service has launched a new online assistant designed to help employers especially small businesses easily determine the right amount of federal income. Withholding Income Tax From Your Social Security Benefits for more information. When you hire an employee they must complete and sign both of the following withholding certificates.

Income tax withholding assistant for employers 2019 Friday February 11 2022 Edit. Federal income tax to withhold from this paycheck is provided in the upper right corner. Salary Lien Provision for Unpaid Income Taxes.

Income Tax Withholding Assistant for Employers For use with both 2020 and earlier Forms W-4 Pay frequency. This Assistant implements the 2020 IRS Publication 15-T Federal Income Tax Withholding Methods. These forms must be submitted to the.

2019 City Income Tax Withholding MonthlyQuarterly Return. State Disability Insurance SDI Personal Income Tax PIT Note. If you pay every week the employees disposable earnings for the week are 52000 the applicable minimum wage is 11 per hour and there is no other order of higher priority.

2019 Employer Withholding Tax. Wages are generally subject to all four payroll taxes. We refer to the amount of wages taken from your paycheck for state and federal income taxes as withholding.

Tax Withholding Estimator Internal Revenue Service

Federal Register Covid 19 Vaccination And Testing Emergency Temporary Standard

What Employers And Employees Should Know About 2019 Tax Withholding Changes

Irs New Downloadable Assistant Helps Small Businesses Withhold The Right Amount Of Income Tax

Publication 505 2022 Tax Withholding And Estimated Tax Internal Revenue Service

Household Help Could Mean More Tax Work For Employers Don T Mess With Taxes

Online Tax Withholding Calculator 2021

Withholding Tax Alabama Department Of Revenue

New Irs Employee Withholding Tool Could Help Your Small Business Clients Gruntworx Llc

New Irs Employee Withholding Tool Could Help Your Small Business Clients Gruntworx Llc

Publication 505 2022 Tax Withholding And Estimated Tax Internal Revenue Service

Propublica Shows How Little The Wealthiest Pay In Taxes Policymakers Should Respond Accordingly Center On Budget And Policy Priorities

The Importance Of Proper Income Tax Withholding Financial Advisors Macco Financial Group Inc Green Bay Wisconsin

What Employers And Employees Should Know About 2019 Tax Withholding Changes